Definition of Profit and Loss Statement

The profit and loss statement, or P&L, is a name sometimes used to describe a company’s income statement, statement of income, statement of operations, or statement of earnings. In short, the profit and loss statement reports a company’s revenues, expenses, and most of the gains and losses which occurred during the period of time shown in the statement’s heading. (A few gains and losses are not reported on the profit and loss statement. Instead, they are reported on the company’s statement of comprehensive income.)

The profit and loss statement’s period of time could be a year, a year-to-date period such as nine months, a quarter of a year, one month, four weeks, 52 weeks, etc.

Under the accrual basis (or method) of accounting the revenues and expenses reported on the profit and loss statement should be:

- Revenues (sales, service fees) that were earned during the accounting period

- Expenses (cost of goods sold, salaries, rent, advertising, etc.) that match the revenues being reported or have expired during the accounting period

Today, the bottom line of this financial statement will appear as net income, which is the net amount of the revenues, expenses, gains, and losses being reported.

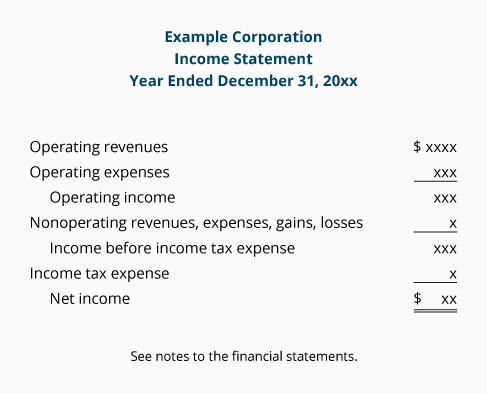

Example of Profit and Loss Statement

The following is an example of the key elements of a profit and loss statement, which officially is known as the income statement.