Single-Step Income Statement Definition

A single-step income statement arrives at a company’s net income in one step or subtraction: [total revenues and gains] – [total expenses and losses].

Example of a Single-Step Income Statement

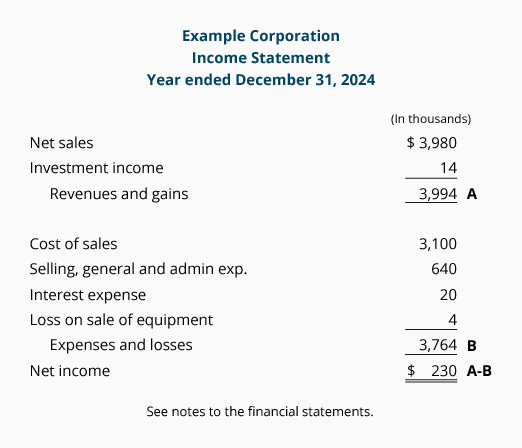

Here is an example of a condensed single-step income statement for a hypothetical sole proprietorship (with our added notation of A, B, and A-B):

Notice these items on the single-step income statement:

- There is only one subtraction: $3,994 – $3,764 = $230

- The operating revenues, nonoperating revenues, and gains are combined into one total of $3,994

- The operating expenses, nonoperating expenses, and losses are combined into one total of $3,764

- The company’s gross profit is not shown as a subtotal. However, the gross profit can be calculated by subtracting the cost of sales from net sales

While the single-step format is not cluttered with multiple subtotals, it requires the reader to compute the gross profit and operating income from the amounts listed.

Single-Step vs Multiple-Step

An alternative income statement format that does not combine the operating and nonoperating amounts and shows explicitly the company’s gross profit and operating income, is the multiple-step income statement.