Introduction to the Cash Flow Statement

Did you know? You can earn our Cash Flow Statement Certificate of Achievement when you join PRO Plus. To help you master this topic and earn your certificate, you will also receive lifetime access to our premium financial statements materials. These include our video training, visual tutorial, flashcards, cheat sheet, quick test, quick test with coaching, business forms, and more.

Earn Our Certificate

for This Topic

When you join PRO Plus, you will receive lifetime access to all of our premium materials, as well as 10 different Certificates of Achievement.

View PRO Plus FeaturesThe cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or SCF. We will use these names interchangeably throughout our explanation, practice quiz, and other materials.

The cash flow statement is required for a complete set of financial statements.

The SCF reports the cash inflows and cash outflows that occurred during the same time interval as the income statement. The time interval (period of time) covered in the SCF is shown in its heading. Two examples include “Year ended December 31, 2023” and “Three months ended September 30, 2023”.

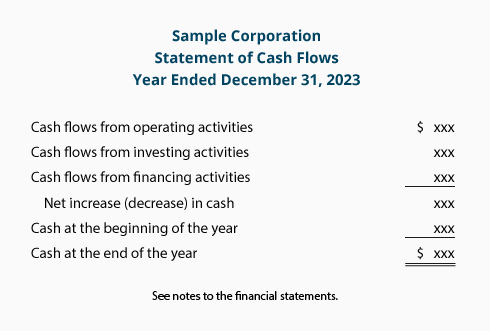

The amounts on the SCF provide the reasons for the change in a company’s cash and cash equivalents during the period covered. For simplicity, we will assume that the company does not have cash equivalents. Therefore, our SCF will explain the change in the company’s cash from the beginning of the year to the end of the year (or the beginning of the quarter to the end of the quarter, etc.). Given our assumption that the company does not have cash equivalents, the following is a skeleton of the SCF’s format:

The cash flows from operating activities section provides information on the cash flows from the company’s operations (buying and selling of goods, providing services, etc.). With the most likely used indirect method, the starting point of this section is the company’s net income. It is followed with adjustments to convert the amount of net income from the accrual method to the cash amount.

The cash flows from investing activities lists the cash flows associated with the purchase and sale of noncurrent (long-term) assets such as investments and property, plant and equipment.

The cash flows from financing activities section reports the cash flows associated with the issuance and repurchase of a corporation’s bonds and capital stock, the payment of dividends, and the borrowing and repayment of short-term and long-term loans.

At the bottom of the SCF (and other financial statements) is a reference to inform the readers that the notes to the financial statements should be considered as part of the financial statements. The notes provide additional information such as disclosures of significant exchanges of items that did not involve cash, the amount paid for income taxes, and the amount paid for interest.

We begin with reasons why the statement of cash flows (SCF, cash flow statement) is a required financial statement.

Please let us know how we can improve this explanation

No ThanksWhy the Cash Flow Statement is Required

The accounting profession realizes that reading only one or two financial statements is not sufficient for understanding a company’s finances and operations. Accordingly, the generally accepted accounting principles (GAAP, US GAAP) require that the statement of cash flows be part of a set of financial statements distributed outside of a company. A complete set of financial statements consists of five financial statements and the notes to the financial statements:

- Income statement

- Statement of comprehensive income

- Balance sheet

- Statement of stockholders’ equity

- Statement of cash flows

- Notes to the financial statements

While the income statement amounts make the news, the amounts are based on the accrual basis of accounting. This method of accounting best measures a company’s sales, expenses, and earnings during a short time interval. However, the income statement does not measure and report the amounts of cash that flowed in and out of the company. For example, the income statement does not report the following:

- Cash collected from sales. (The cash might be collected from customers 45 days after the sale.)

- Cash paid for goods sold. (Payment may have been made many months prior to their sale.)

- Cash paid for buildings and equipment that will be expensed over the next 5 to 30 years.

- Cash received from the sale of long-term assets

- Cash received from bank loans

- Cash payments to reduce a loan’s principal balance

- Cash withdrawn by owners or cash dividends paid to stockholders

A company’s understanding of its cash inflows and outflows is critical for meeting its short-term and long-term obligations to its suppliers, employees, and lenders. Current and potential lenders and investors are also interested in the company’s cash flows.

Financial analysts will review closely the first section of the cash flow statement, cash flows from operating activities. Part of the review consists of comparing this section’s total (described as net cash provided by operating activities) to the company’s net income. This is done to see whether the revenues, expenses, and net income reported on the income statement are consistent with the change in the company’s cash balance.

If they are not consistent, they will seek to uncover the root causes for the differences. Perhaps the company’s inventory is no longer in demand or is being returned by customers. Perhaps receivables are not being collected, and so on. (In short, the analyst believes that “Cash is king”. While there can be some leeway in applying accounting principles, there is no leeway when it comes to reporting the amount of cash.)

Lastly, the SCF provides the cash amounts needed in some financial models.

Please let us know how we can improve this explanation

No ThanksExample of a Cash Flow Statement

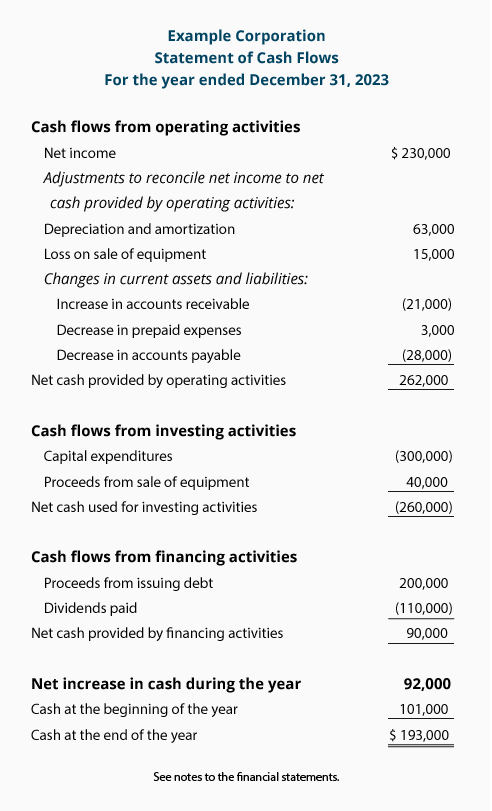

The following is an example of the statement of cash flows, which is commonly referred to as the cash flow statement or SCF. (The company and the amounts shown are hypothetical.)

The heading for Example Corporation’s statement of cash flows indicates that the amounts occurred during the year January 1 through December 31, 2023.

In bold font you see subheadings for the three sections of the SCF. Many corporations omit “Cash flows from” and simply show the following as the subheadings:

- Operating activities

- Investing activities

- Financing activities

Some amounts are shown in parentheses, while other amounts are not. We will cover these in detail later, but let’s introduce the technique by looking at the amounts shown for investing activities:

-

The amount (300,000) communicates that cash of $300,000 was paid out, was a cash outflow, or that it reduced the company’s cash balance. Parentheses can also be thought of as having a negative or unfavorable effect on the company’s cash balance.

-

The amount 40,000 indicates that cash of $40,000 was received, was a cash inflow, or that it increased the company’s cash balance. Amounts without parentheses can also be thought of as having a positive or favorable effect on the company’s cash balance.

-

The (260,000) is described as the net cash used for investing activities. “Net” means the combination of the cash outflow of (300,000) and the cash inflow of 40,000.

The amount 92,000 shown on the line Net increase in cash during the year is the combination of each section’s sum: 262,000 + (260,000) + 90,000. Since this net amount or grand total is a positive amount, it is shown without parentheses and is described as net increase in cash during the year.

Note that the net increase (or net decrease) in cash during the year is combined with the cash at the beginning of the year to show the cash at the end of the year. In our example, it is 92,000 + 101,000 = $193,000. The end of the year balance of $193,000 should agree with the cash balance on the company’s balance sheet for December 31, 2023.

Lastly, at the bottom of all financial statements is a sentence that informs the reader to read the notes to the financial statements. The reason is that not all business transactions can be adequately expressed as amounts on the face of the financial statements.

Please let us know how we can improve this explanation

No Thanks