Introduction to Nonprofit Accounting

From churches to youth organizations to the local chambers of commerce, nonprofit organizations make our communities more livable places. Unlike for-profit businesses that exist to generate profits for their owners, nonprofit organizations exist to pursue missions that address the needs of society. Nonprofit organizations serve in a variety of sectors, such as religious, education, health, social services, commerce, amateur sports clubs, and the arts.

Nonprofits do not have commercial owners and must rely on funds from contributions, membership dues, program revenues, fundraising events, public and private grants, and investment income.

Our intent is to merely introduce some of the basic concepts that are unique to nonprofit accounting and reporting that are required by the Financial Accounting Standards Board (FASB).

We will not discuss the accounting which is similar to that used by for-profit businesses. If you are not familiar with accounting for businesses or you need a refresher, you will find explanations, practice quizzes, quick tests, and more at our course outline.

Accountants often refer to businesses as for-profit entities and to nonprofit organizations as not-for-profit entities, or NFPs. We will be using the more common term nonprofit instead of not-for-profit.

Again, this is a very brief introduction to nonprofit accounting. There are many different types of nonprofits, including governmental nonprofits, which we will not address.

Note: We developed seven business forms to assist you in preparing the financial statements of a nonprofit organization. You can find additional information at AccountingCoach PRO.

Please let us know how we can improve this explanation

No ThanksNonprofits vs. For-Profit Corporations

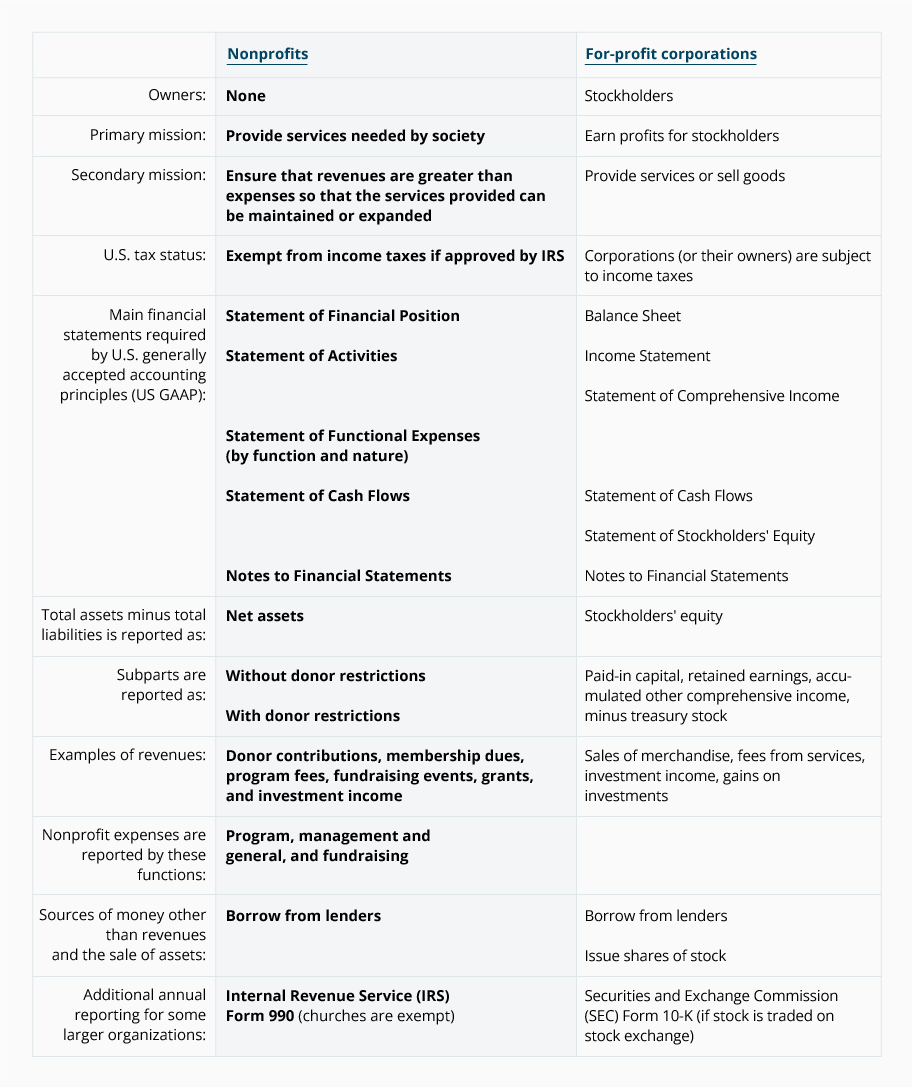

The following table highlights some of the key differences between nonprofit organizations and for-profit corporations:

Please let us know how we can improve this explanation

No ThanksMission and Ownership, Tax-Exempt Status

Mission and Ownership

While businesses are organized to generate profits, nonprofits are organized to address needs in society. As a result, nonprofits will issue a statement of activities instead of the income statement issued by for-profit businesses.

Since nonprofits do not have owners, there is no owner’s equity or stockholders’ equity and there cannot be distributions to owners.

Some people mistakenly assume that if an organization is designated as a nonprofit, it cannot legally earn profits. In fact, having more revenues than expenses is almost a necessity for a nonprofit if it hopes to withstand such things as:

- unexpected expenses

- uneven flows of revenues

- a decrease in revenues

- rising costs due to inflation

- an increase in staffing needs

- an increase in the need for its services

- a purchase or replacement of needed equipment

- other needs since a nonprofit cannot issue shares of stock

Tax-Exempt Status

Nonprofit organizations may apply to the Internal Revenue Service in order to be exempt from federal income taxes.

A second issue is whether a donor’s contribution to a nonprofit organization will qualify as a charitable deduction on the donor’s income tax return. For example, churches, schools, and Red Cross chapters are some of the nonprofits that will qualify as tax-exempt and their donors’ contributions will also qualify as charitable deductions on the donors’ income tax returns.

However, there are nonprofits that qualify as tax-exempt but their donors’ contributions do not qualify as charitable deductions (although they may qualify as business expenses). Examples of these nonprofits include social organizations, chambers of commerce, college fraternities and sororities, amateur sports clubs, employee organizations, and more.

You can learn more about the tax-exempt status for a nonprofit, the deductibility of contributions by donors, and the taxability of activities not directly related to a nonprofit’s exempt purpose in the Internal Revenue Service Publication 557, Tax-Exempt Status for Your Organization, which is available at no cost on IRS.gov.

Even if a nonprofit is exempt from federal income taxes, it is likely that its employees will be subject to employment taxes. Nonprofits may or may not be exempt from sales taxes, real estate taxes, and other taxes depending on which state in the U.S. they are incorporated or operate.

Please let us know how we can improve this explanation

No Thanks