Disposal of Assets

If a company disposes of (sells) a long-term asset for an amount different from the amount in the company’s accounting records (the asset’s book value), an adjustment must be made to the amount of net income appearing as the first item on the SCF.

To illustrate, assume a company sells one of its delivery trucks for $3,000. The truck is in the accounting records at its original cost of $20,000. Its accumulated depreciation is $18,000. Combining the $20,000 and the $18,000 results in a book value (or carrying value) of $2,000.

Because the cash received/proceeds from the sale of the truck was $3,000 and the book value was $2,000 the difference of $1,000 is reported as a gain on the income statement. As a result, the company’s net income will increase by $1,000. (If the truck had sold for $1,500 there would be a $500 loss, which would reduce the company’s net income.)

One of the rules in preparing the SCF is that the entire proceeds received from the sale of a long-term asset must be reported in the section of the SCF entitled investing activities. This presents a problem because any gain or loss on the sale of an asset is included in the amount of net income shown in the SCF section operating activities. To overcome this problem, each gain is deducted from the net income and each loss is added to the net income in the operating activities section of the SCF.

We will demonstrate the loss on the disposal of an asset in Good Deal’s next transaction.

Please let us know how we can improve this explanation

No ThanksJuly Transactions and Financial Statements

On July 1, Matt decides that his company no longer needs its office equipment. Good Deal used the equipment for one month (June 1 through June 30) and had recorded one month’s depreciation of $20. This means the book value of the equipment is $1,080 (the original cost of $1,100 less the $20 of accumulated depreciation). On July 1, Good Deal sells the equipment for $900 in cash and reports the resulting $180 loss on sale of equipment on its income statement. There were no other transactions in July.

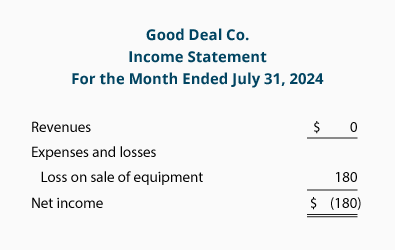

The income statement for the month of July will show how the disposal of the equipment is reported:

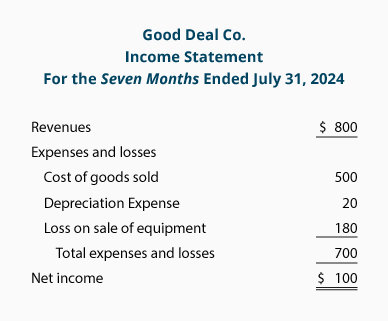

The income statement for the period of January 1 through July 31 is:

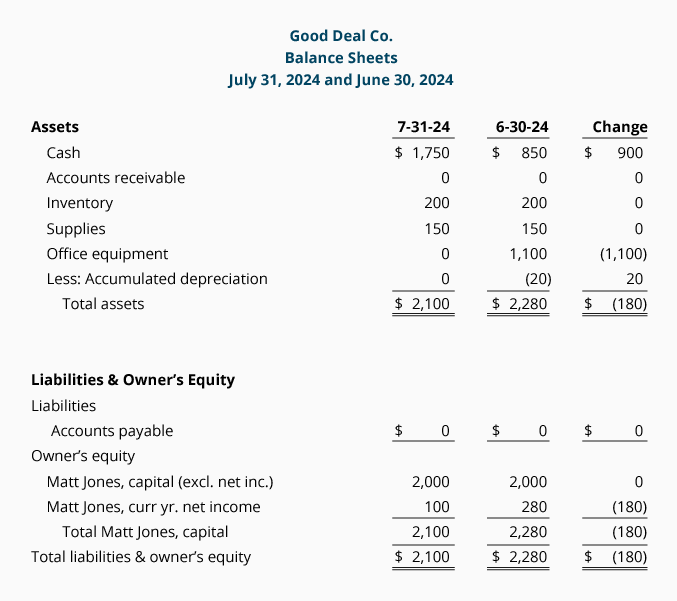

The following comparative balance sheet shows the changes that occurred during July:

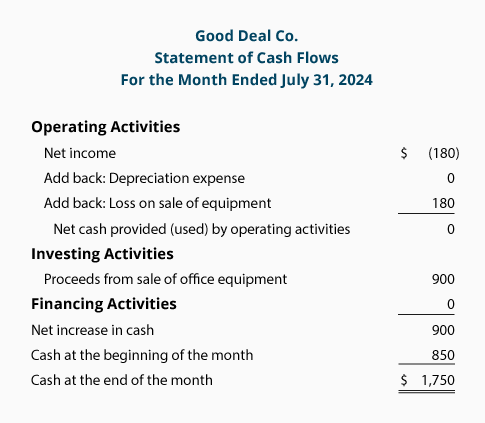

The SCF for the one month of July is:

Let’s review the cash flow statement for the month of July 2023:

-

Net income for July was a net loss of $180. There were no revenues, expenses, or gains, but there was a loss of $180 on the sale of equipment. However, the loss did not cause the company’s cash to decrease. The $900 of cash that was received is shown under investing activities.

-

There was no depreciation expense in July because the asset was sold on July 1. (We could have omitted the line “Depreciation Expense”.) Also, the current assets and current liabilities did not change in July.

-

The net amount of cash provided or used by operating activities during the month of July was $0.

-

The investing activities section reports the $900 received from the sale of its office equipment.

-

There was no change in short-term loans payable, long-term liabilities, or owner’s equity during July (other than the $180 loss on sale of equipment).

-

The sum of the amounts on the SCF for the month of July was a positive cash inflow of $900. This amount agrees to the increase in the company’s cash balance from June 30 to July 31.

-

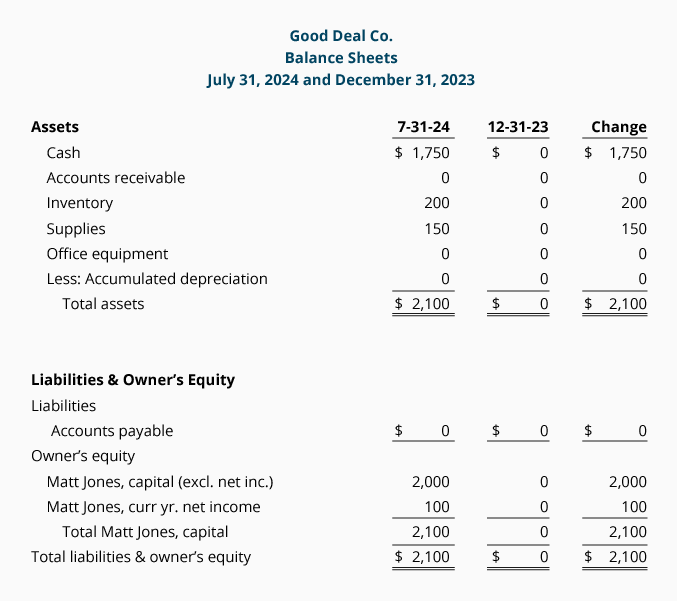

The following comparative balance sheet shows the changes between December 31, 2022 and July 31, 2023:

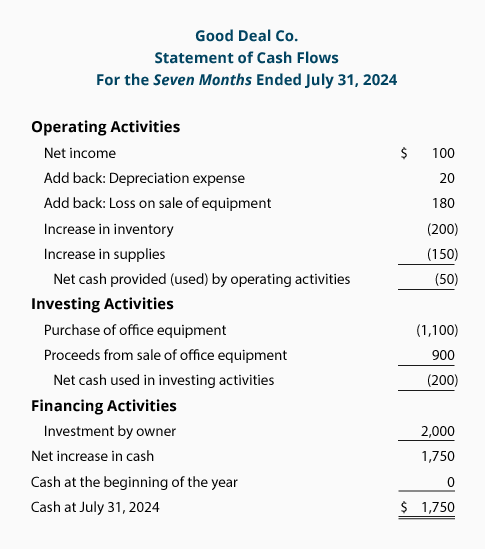

The SCF for the period of January 1 through July 31 is:

Let’s review the cash flow statement for the seven months of January through July 2023:

-

Net income for the seven months was $100. This includes the company’s revenues, gains, expenses, and losses.

-

Included in the net income for the seven months is $20 of depreciation expense. This expense reduced net income but did not reduce the Cash account. Therefore, the $20 of depreciation expense is a positive adjustment to the $100 of net income.

-

Also included in the net income was the $180 loss on sale of equipment. This loss was reported on the income statement thereby reducing net income. However, cash was not reduced. Actually, cash of $900 was received from the sale of the equipment and it is reported in its entirety in the investing activities section of the SCF.

-

Inventory on July 31 is $200 (4 calculators at a cost of $50 each). Since the company began with no inventory, this increase in the Inventory account means that $200 of cash was used to increase inventory. Hence, the adjustment is shown in parentheses.

-

Supplies increased from none to $150. The increase in the Supplies account is assumed to have had a negative effect of $150 on the company’s cash.

-

Combining the amounts so far, we see that the net amount of cash from operating activities is a negative $50. In other words, rather than providing cash, the operating activities used a net $50 of cash.

-

There is cash outflow (or payment) of $1,100 to purchase the office equipment on May 31. On July 1, there was also a $900 cash inflow (or receipt) from the sale of the office equipment. Combining these two amounts results in the net outflow of $200 in the investing activities section as a source of cash.

-

The owner’s investment of $2,000 made on January 2 is reported in the financing activities section.

Net increase in cash during the seven months was a positive $1,750 (the combination of the totals of the three sections—operating, investing, and financing activities). This $1,750 agrees to the check figure—the increase in the cash from the beginning of January to July 31.

Please let us know how we can improve this explanation

No ThanksWhen you join PRO Plus, you will receive lifetime access to all of our premium materials, as well as 10 different Certificates of Achievement.

Earn Our Certificate

for This Topic